Fueled by the climate crisis, shareholder activism, and government policy, consumer demand is moving toward electro mobility (e-mobility)—one of the most radical transformations to the transportation industry since the internal combustion engine.

E-mobility—which refers to electric powertrain and in-vehicle communication technologies along with the connected infrastructure that enables electric vehicles and fleets—is poised to transform how consumers, industries, and businesses operate.

Learning to understand the various types of financing available to business owners hoping to pursue e‑mobility opportunities, however, can be overwhelming. When a business needs financing, selecting the type of financing and financing partner is extremely important. Explore financing options and their benefits and drawbacks below.

Emerging Technology

As new technology fills with emerging businesses, there will be different needs and considerations than those of mature businesses in established markets and industries, particularly with respect to funding.

Early-stage businesses typically require significant sustained funding before they’re able to generate positive cash flow.

Types of Financing

Debt and equity comprise the broadest categories of available financing.

The main difference is that debt pertains to a contractual obligation for repayment, whereas equity represents a residual claim on a company’s assets after all liabilities have been paid.

Debt

During the start-up phase, founders often secure debt financing from family and friends as established lender financing options will be limited.

Personal assets used as collateral and personal guarantees may increase the ability to secure debt financing. If the business isn’t generating sufficient positive cash flow, it simply won’t be able to obtain significant debt financing.

Public Equity

Public equity is an equity security traded on a national public exchange, such as the New York Stock Exchange. There are also equity securities listed on over-the-counter exchanges and entities that must adhere to some SEC oversight and reporting, but whose equity securities aren’t listed on a national securities exchange.

The three ways that a businesses can initially list its shares on a US national public exchange are through an initial public offering (IPO), direct listing, and reverse merger which includes use of a special purpose acquisition company (SPAC) transaction.

Publicly traded companies can raise funds from a large pool of new investors without relinquishing control to investors. However, they face requirements for public disclosure and adherence to regulatory oversight. These combined factors point towards public equity markets not being an attractive or viable option for most early-stage companies.

Private Equity

Private equity in this context refers to the entire asset class of equity investments not quoted on stock markets.

Private equity ranges from venture capital (VC), working with early-stage companies, to growth equity, providing capital to expand established private businesses by taking a minority interest, all the way to large leveraged buyouts of the entire company and public-to-private transactions when the target is publicly traded.

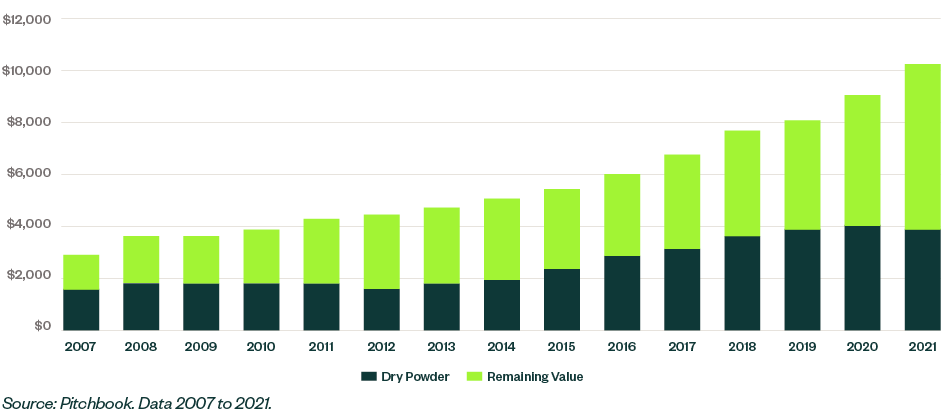

According to Pitchbook, private equity registered record-highs in deal and exit activity globally in 2021—both in terms of deal number and aggregate deal value—which also pushed buyout exit valuations to new heights. US venture capital deal value came in at more than double the previous record set in 2020.

Rise of Private Capital Investments

Private capital assets under management (AUM), including equity and debt, more than doubled since 2013. They reached $9.9 trillion at the end of 2021, while remaining just 4% of global financial assets, per Pitchbook.

Private Capital Assets Under Management (Millions)

Private companies have lower legal, regulatory, and accounting requirements than publicly traded companies. They also can manage their business without external oversight, which can help management focus on long-term goals.

Publicly Traded Stock Prices Versus Private Equity Values

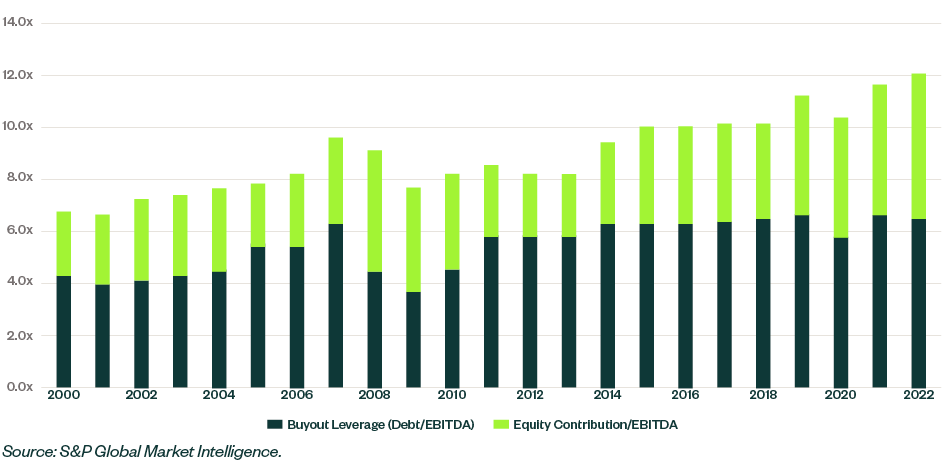

According to S&P Global Market Intelligence, in the first quarter of 2022, the average private equity (PE) buyout was 12.2 times earnings before interest, taxes, depreciation, and amortization (EBITDA).

Enterprise value (EV) to EBITDA multiples of S&P 500 sectors ranged from 13.6 to 25.1 times.

Annual Average of Quarterly Buyout Multiples (2000 – Q1 2022)

Private companies disclose less information, which may make them less efficiently priced. In simple terms, stock prices are the result of supply and demand, which may differ from the actual value of those same stocks. Similarly, M&A transactions reflect the price of acquiring the company, as opposed to the value of the company.

Stock prices can fluctuate with little relationship to value for extended periods of time.

The reported volatility of the US Private Equity index was almost 50% lower than the S&P 500 and even below that of the 10-year US government bond from 1994 through 2019.

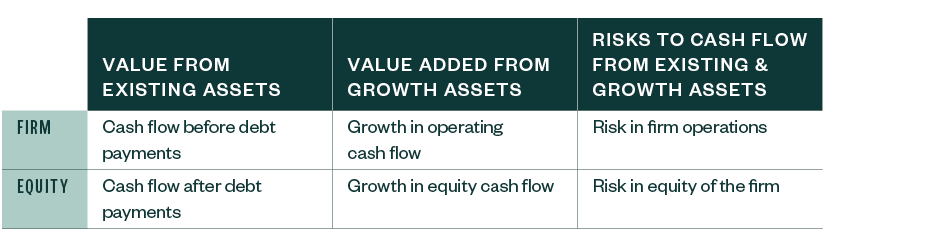

It’s worth noting that private equity portfolio companies are influenced by the same economic factors as public companies, even if they aren’t reflected in their valuations. Value can be driven by things like cash flow from existing assets, cash flow from growth assets, and the quality of a company’s growth. Drivers of price include supply and demand, market moods, momentum, and stories about fundamentals.

Information, liquidity, and corporate governance can act to increase or decrease the gap between price and value.

Clash Flow and Risk: Equity Versus the Firm

When private equity funds make an investment or acquire a business, they pay a price based on the market (supply and demand) analogous to publicly traded equities, but with less liquidity and less transparency.

Thereafter, they report values of their investments—monthly, quarterly, or annually—based on estimates derived from valuation models which are more rooted in a fundamental evaluation of expected cash flows.

Examples from the Electric Mobility Industry

There are myriad examples of accessing capital throughout the business life cycle from the e‑mobility industry. A selection follows to help you see the tangible impact of decisions.

BrightDrop

A General Motors (GM)-owned tech start-up achieved commercialization of its electric van in just 20 months by leveraging the partnership with GM.

The relationship let BrightDrop operate with the agility of a start-up while leveraging GM’s experience and resources.

SES

A company focused on lithium metal battery technology, SES accessed numerous financing options throughout its existence.

After relying on Series A equity financing from an early stage venture capital firm and a family office, it secured Series B financing from GM and Shanghai Auto.

As it moved through its business lifecycle, SES used strategic partnerships and additional rounds of financing before eventually going public through a SPAC merger in 2021.

Solid Power

Instead of using equity financing in the early stages of its business life cycle, Solid Power obtained initial funding through grants and federal contracts.

The company secured Series A financing almost seven years after its founding. Series B investors included BMW, Ford, and Volta Energy Technologies.

Ten years after its founding, Solid Power became a publicly traded company through a SPAC merger in December 2021.

Redwood Materials

Founded by an ex-Tesla co-founder, Redwood Materials used strategic partnerships and multiple rounds of financing to grow a business focused on reducing the environmental impact of battery production.

Investors include numerous established vehicle manufacturers including Ford, which described the strategic investment to integrate Redwood’s battery recycling into Ford’s strategy.

Monarch Tractor

Spun off from Motivo Engineering in 2019, Monarch Tractor accessed additional capital through venture capital funds and other strategic partnerships.

The company deploys products through the help of USDA grant programs that assist farmers in integrating and testing Monarch’s electric tractors.

We’re Here to Help

To learn more about how to assess your options from public financing through an IPO or various types of private financing, contact your Moss Adams professionals.

You can also visit our Valuation Services and Automotive & Dealer Services Practice.